If you’re looking to maximize your profit on a commercial property sale, broker commissions are a key consideration.

While choosing a reduced commission fee may seem like a cost-saving strategy, it can lead to various challenges:

- Experienced brokers, with valuable market knowledge, negotiation skills, and a track record of successful transactions, might refuse to work with you.

- Fewer resources will be allocated for effective property marketing, resulting in a longer time on the market and potentially lower property values.

- Your broker will likely prioritize other listings that offer more lucrative commissions.

- Cooperating brokers won’t share your listing with their clients, reducing your property’s exposure to potential buyers.

However, a high commission fee doesn’t guarantee quality representation either.

To make informed decisions and maximize your property’s sale profit, you need to understand commercial real estate commission structures — which is what we’ll delve into in this article.

Looking to sell your commercial property quickly and seamlessly while maximizing returns?

Contact us via our online form, email us at [email protected], or call 818.482.3830 for a free property valuation and custom commission structure.

How Do Commercial Real Estate (CRE) Commissions Work?

The commercial real estate commission is typically a percentage of the property’s selling price. Rates are negotiable and can vary, but they commonly range from 3% to 6% of the transaction value.

When it comes to leases, the commission is usually a percentage of the revenue of the initial lease term.

For example, if a building is leased for $5,000 per month on a 3-year lease, it generates the building owner $180,000 in revenue. If the negotiated commission is 5%, the broker gets $9,000 (=$180,000×0.05).

Real estate brokers or agents earn these commissions by representing either the buyer/tenant or the seller/landlord. In most cases, the commission is divided between the two brokers.

While there are common practices, commission structures can vary — it’s important to clarify terms in the listing agreement or contract.

Lastly, commissions are paid at the closing of the transaction; the funds come from the proceeds of the sale or lease.

Who Pays the Commission in a Commercial Real Estate Transaction?

When selling a commercial property, the seller covers the commission fee. Landlords bear the cost in leasing transactions.

The Value You Get From Paying Commercial Real Estate Commission Fees

Commercial real estate sellers and lessors get a lot of value from paying commission fees to a skilled CRE broker.

For starters, brokers bring expertise and local market knowledge to the table, allowing them to negotiate favorable terms on your behalf.

In addition, agents promote the property to a wider audience and save you time by handling complex processes, including having access to proper seller disclosure documents, such as Property Information Sheet, Seller’s Mandatory Disclosure, and CA Earthquake Disclosure.

Finally, the commission fee covers marketing efforts. An experienced broker employs tried-and-tested marketing strategies and promotes your property to their network of buyers. This proactive approach will help you sell quicker and secure a more favorable outcome.

To gauge the value you’ll get from working with a CRE broker, examine their track record in similar transactions and seek feedback from previous clients.

If you need help selling your commercial property, we invite you to take a look at:

- The “Sold” and “Leased” tabs on our listings page, displaying dozens of successful CRE transactions we’ve facilitated.

- Our YouTube videos, showcasing how we highlight each property’s main selling points to attract the right buyer and maximize sale value.

- Our past client reviews on Google and Yelp (both are currently standing at 5/5 stars).

If you feel we’re a good fit, email us at [email protected] or call 818.482.3830 for a no-obligation, free property valuation and custom commission structure.

How Are Commercial Real Estate Commission Fees Calculated?

Commercial real estate commission fees are typically calculated as a percentage of the property’s sale or lease price. These rates are negotiable, often falling within the range of 3-6% — several factors influence these fees.

For instance, larger or more expensive properties may be negotiated at lower commissions. Regional regulations also play a role. Different property types may command distinct commission percentages, with more intricate deals justifying higher commissions.

Additionally, market conditions, such as supply and demand, can impact fees. For instance, in a hot market, it’s easier to sell a property, leading to discounted fees.

Conversely, in times of increased supply or low demand, commission fees are typically higher — and it becomes crucial to work with a seasoned broker for effective marketing and sale.

You need a broker who understands your property functions and utility, as well as the local market, so they can market your property to the type of buyer who values it most.

Take a look at the following example, showcasing how we calculated the commission fee and facilitated a complex property sale by understanding local regulations and marketing it to the right type of buyer.

Commercial Real Estate Commission Calculation Example

An example of an intricate deal commanding a higher commission fee is the freestanding manufacturing building in Sun Valley we helped sell. The tenant had been operating a plating and anodizing shop using chemicals and pollutants for 25 years.

Before proceeding with the sale, we needed to provide the city of Los Angeles and the fire department with a closure plan — a comprehensive document outlining procedures to safely shut down a facility operating with hazardous materials.

The fire department referred us to a list of consultants that could potentially certify the closure plan, but it was particularly difficult to find an engineer registered in California with the certifications needed to approve this type of closure plan.

In addition, all existing platforms and interior build outs had to be demolished, all debris and materials needed to be decontaminated, and the entire warehouse had to be triple rinsed.

This entire process was arduous, complex, and needed a broker who had the experience and capacity to facilitate it.

To close the deal, we had to:

- Put the right team together

- Make sure they were working collaboratively

- Keep communication open throughout the whole process

- Market the property in its current state and find a buyer willing to take on this long and arduous project

- Figure out how to get a closure plan that would be approved by the city and fire department

Closing the sale of this industrial property required a lot of time and resources, so we charged a 6% commission fee. Ensuring your broker is adequately compensated in challenging situations is crucial for maximizing your sale proceeds.

Working with an experienced broker, who specializes in commercial real estate transactions in your local market, is also essential for a successful transaction.

With over 10 years of experience as a commercial real estate broker in LA and surrounding counties, Alex Matevosian and our team can help you sell your property quickly while maximizing profit.

Contact us via our online form, email us at [email protected], or call 818.482.3830 for a free property valuation and custom commission structure.

Does the Price of the Commercial Property Dictate the Commission Fee?

The commission fee for commercial properties is influenced by various factors, including property type, size, regional norms, market conditions, and deal complexity, as mentioned earlier.

So, yes, the price of the commercial property does play a role in determining the commission fee, but it’s not the only factor at play. As you saw in the example above, deal complexity plays a major role.

What Is the Typical Commission Split in Commercial Real Estate?

The typical commission split in commercial real estate is negotiable and can vary. This split often occurs between the broker representing the buyer/tenant and the one representing the seller/landlord.

A common arrangement is a 50-50 split between the buyer’s agent and the seller’s agent.

In sale transactions, the distribution of commissions is managed by escrow. The brokerage sends escrow a commission distribution agreement, providing instructions on how the check will be made out and distributed.

Example of a Typical Commercial Real Estate Commission Structure

As mentioned, a commercial real estate commission typically ranges from 3 to 6% of the transaction value.

Let’s consider a scenario where it’s set at 4%. If the total sale value of a commercial property is $2.3 million, the corresponding commission fee would amount to $92,000 (=$2.300.000×0.04).

How Much Is the Average Commercial Real Estate Commission in California?

The average real estate commission on a commercial property in California is 5.11%, standing slightly below the national average of 5.49%.

What Is the Maximum Commission a Commercial Real Estate Broker Can Charge?

The maximum commercial real estate commission rates a broker can charge aren’t legally capped or fixed. Instead, it’s determined through negotiation and agreement between the parties involved.

What Is a Reasonable Commercial Real Estate Brokerage Fee?

Determining a reasonable commercial real estate brokerage fee can be challenging due to various factors influencing commission rates, including property type, size, price, regional regulations, market conditions, and deal complexity.

For instance, a simple transaction of a mid-sized commercial property, during times of high demand, may command a 4% commission fee.

However, more complex transactions requiring extensive marketing efforts, team coordination for documentation, and more, may result in higher commissions, ranging between 5 to 6%.

The example we included above provides more clarity on why some deals command higher commercial real estate commission fees than others. Check it out if you haven’t yet.

Are There Other Costs Associated with Selling a Commercial Property?

Yes, selling a commercial property involves various costs beyond the commission fee, including:

- Closing costs like title insurance, escrow fees, and legal expenses

- Making your property more appealing with repairs, staging, cosmetic improvements, energy efficiency upgrades, and more

- Advertising and promotional expenses, which are included in broker/agent fees

- Clearing outstanding property taxes or liens

- Legal, accounting, and appraisal fees (in some cases, you can get a property valuation for free instead of paying for an appraisal)

- Applicable local and federal taxes — you can defer taxes with a 1031 exchange

- Potential repayment of any existing mortgage or loans on the property

- Potential loan origination fees

- Phase 1 ESA report (potentially Phase 2 and 3 ESA reports as well)

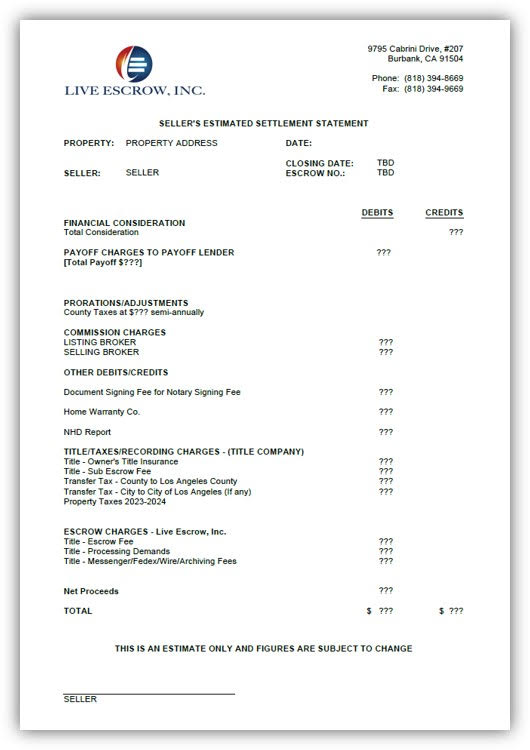

If you’re a commercial real estate owner planning to sell your property, understanding these additional costs is crucial. You can use a seller net sheet to better estimate the sale profit.

How to Use a Seller Net Sheet to Estimate the Profit of Your Commercial Property Sale

A seller net sheet is a useful financial tool for estimating proceeds from a commercial property sale.

While not legally required, it provides sellers with estimated numbers to assess potential financial outcomes, make informed pricing decisions, and negotiate effectively.

The sheet includes figures like property sale price, outstanding loan balances, closing costs, and agent commissions, among others.

The estimated profit is determined by subtracting total costs from the sale price, resulting in the seller’s net profit.

Here’s a seller net sheet example:

Normally, you’ll receive the first net sheet when interviewing and selecting a CRE broker. A premium broker will provide you with an updated net sheet with each received offer to help you compare offers on an equal standing and identifying the most advantageous offer.

In summary, utilizing a seller net sheet ensures sellers have a clear understanding of their potential profit throughout the commercial property sale process.

How Much Is the Commission on a Commercial Lease in California?

The typical commission for a commercial real estate lease in California ranges from 4 to 6% of the total rent over the term of the lease.

The “total rent over the term of lease” is the sum of all rent payments made by the tenant throughout the entire duration of the lease agreement.

To illustrate, if the lease term spans five years, the total rent over the term includes all payments made by the tenant over those five years.

Why Reducing Commercial Real Estate Commission Fees Can Lower Your Sale Profit

Commercial real estate commissions play a crucial role as incentives for brokers to secure favorable deals and ensure successful transactions for their clients.

When commissions are lowered, agents may have reduced motivation to prioritize and negotiate on your behalf.

Experienced and skilled brokers, in particular, likely won’t take on listings with low commission fees, reducing the quality of your representation.

In addition, a lower commission may result in fewer resources allocated to effective property marketing, leading to a longer time on the market and potential price reductions.

While reducing the commission may seem like a cost-saving measure, it could negatively impact your profit by influencing the sales process and outcomes.

Selling Your Industrial or Commercial Property? Work with an Experienced Broker to Maximize Profit

To sell your industrial or commercial property quickly and seamlessly, at maximum profit, it’s essential to pay an adequate commission fee and work with a skilled commercial real estate broker.

Our team of seasoned professionals and agents can help you navigate every step of your commercial property sale, ensuring a smooth process from start to finish.

Reach us via our contact form, email us at [email protected], or call 818.482.3830 today to start the process of selling your commercial or industrial property.