California’s commercial real estate market has been growing rapidly in recent years, thanks to its thriving economy and population. As businesses continue to expand here, demand for commercial property is increasing exponentially.

However, before you jump into the market, you need to understand the legal requirements for selling commercial property in California. Among the most important of them is disclosing any known defects or issues with the property to potential buyers. By law, California commercial real estate sellers must issue legal disclosures of everything from physical defects like structural damage to environmental hazards and knowledge of any leases encumbering the property.

In this article, we explain what the requirements are for seller’s disclosures in California and why it’s important for you as a seller to file them.

What Is a Seller’s Disclosure?

A seller’s disclosure can refer to two types of legal documents that provide information about the condition of the property being sold. These are:

- The property information sheet

- The seller’s mandatory disclosure form

These documents are designed to protect real estate buyers by informing them of any known defects or issues with the property before the sale. Commercial property disclosures in California are mandatory for any real estate transaction. Failure to provide accurate and complete information can result in legal consequences for the seller.

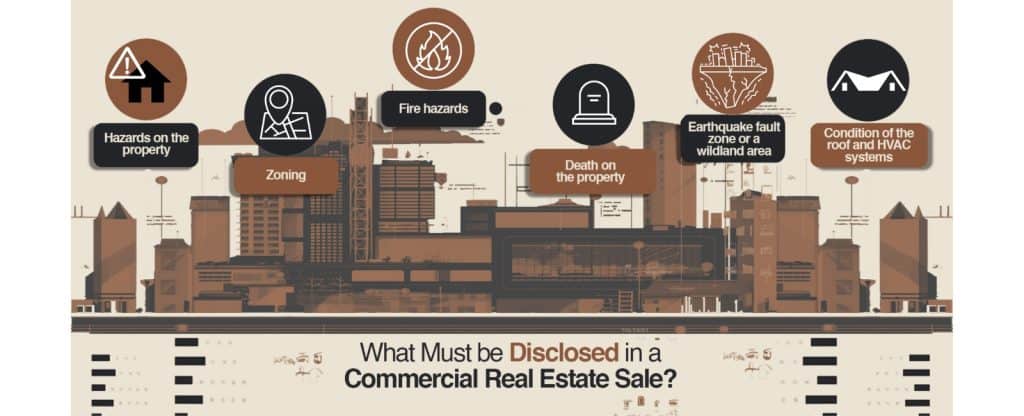

What Must Be Disclosed in a Commercial Real Estate Sale?

- Seller’s disclosures covers a range of issues, including:

- The physical condition of the property

- Any known defects or hazards

- Any repairs or renovations that have been made to the property

- The property’s appliances, systems, fixtures, and warranties or guarantees that may be in place

- Existing lease(s) on the property, along with any options the lease(s) may have

The disclosure must also include information about any encroachments, easements, or boundary disputes that may affect the property.

If you’re still not entirely clear about what to include in your seller’s disclosure, it’s best to consult with a real estate lawyer or agent who can help you with formatted seller’s disclosure templates.

Types of Seller’s Disclosures

Commercial real estate disclosures in California can cover a wide range of topics relating to the condition of a property being sold. In addition to the things mentioned earlier, several other types of seller disclosures may be required or recommended.

- For example, you must disclose hazards on the property, including things like mold, radon, or other environmental hazards. If the property is located in a flood zone or wildfire risk area, that information must also be disclosed to the buyer.

- Another critical area of disclosure is zoning. The seller is required to disclose any known zoning restrictions or requirements that may affect the property, such as building size restrictions or allowable uses. If the original sellers have received any city notices regarding zoning changes or variances, those must be disclosed as well.

- In some cases, the seller may need to disclose information about fire hazards, such as if the property is in a high-risk fire zone or has a history of fire damage.

- If there has been a death on the property within the last three years, the seller must also disclose that information to the buyer. Similarly, if there is a current lease on the property, this must also be disclosed to the buyer.

- Sellers may need to disclose whether the property is in an earthquake fault zone or a wildland area, which can affect the property’s safety and insurance requirements.

The condition of the roof and HVAC systems may also be included in the seller’s disclosure, as these are important components of the property’s overall condition.

Risks for Sellers if Disclosures Are Not Made

As a seller, knowingly failing to file disclosure forms can have dire legal consequences, including direct financial liability. For instance, if the buyer is unaware that the city has rezoned a property, it may lead to a lawsuit and the possibility of the buyer canceling the sale.

Additionally, sellers who transact off-market may not have access to the same disclosure forms and legal resources as those who work with professional agents and brokers. This can put some sellers at a disadvantage when it comes to disclosing all necessary information and protecting themselves from legal liability.

We highly recommend working with a professional agent or broker. These professionals have the knowledge and resources to ensure that all necessary disclosures are made and can guide you in avoiding legal liability. We are one of California’s most well-known real estate service firms. Contact our offices if you have any questions, and we’ll be sure to guide you through the entire process.

What Should Buyers Look for in Disclosures?

Buyers should carefully review all seller disclosures when considering a property purchase. Here are some of the aspects buyers should consider in disclosures:

- The physical condition of the property: The disclosure should include information about the property’s overall condition, including any known defects or issues. Buyers should pay particular attention to any disclosures related to the roof, foundation, plumbing, electrical, and HVAC systems.

- Hazard disclosures: Buyers should be made aware of any known hazards associated with the property, including but not limited to mold, lead, asbestos, and earthquake or wildfire risk.

- Zoning disclosures: Buyers should also be aware of any known zoning restrictions, conditions, or requirements that may affect the use of the property.

- Previous repairs or renovations: Real estate buyers in California should look into the disclosure of past repairs or renovations made to the property, including any warranties or guarantees associated with these repairs.

- Lease agreements: Buyers should also be aware of any lease agreement terms a commercial property is currently under.

- Environmental disclosures: Any known environmental issues related to the property, such as contamination from previous land use or storage of hazardous materials, are another topic that purchasers should be made aware of.

FAQs about Seller’s Disclosures

What if a seller lies in the disclosure filing?

If a seller knowingly lies in a disclosure filing, they can face legal consequences such as a lawsuit or financial penalties, depending on the case. Buyers who discover that a seller lied on their disclosure form may have the right to rescind the sale or seek damages.

It’s important for sellers to disclose all known defects or issues with the property and to be truthful in their disclosures.

How long do sellers and their agents have to get the disclosures to the buyer?

In California, sellers and their agents must provide buyers with disclosure forms within a specific timeframe. According to the AIR contracts used by commercial real estate brokers, the seller must provide the buyer with the seller’s mandatory disclosure form and the property information sheet within 10 days of the date of the agreement.

This is the boilerplate version. It can be negotiated to be longer or shorter, depending on the circumstances. The buyer has 10 days after receiving the disclosure to approve or disapprove of the matters disclosed.

Can a buyer waive their right to receive disclosures?

While buyers have the right to receive all necessary disclosures from the seller, they may choose to waive this right. However, buyers need to understand the risks involved in waiving their rights. If a buyer discovers defects or issues with the property after the sale has closed, they may have limited legal recourse.

We Can Help With Your Commercial Real Estate Disclosures

When it comes to selling your commercial property in the San Fernando Valley and surrounding areas of Southern California, you can always trust me, Alex Matevosian. My goal is to always secure the maximum value for my clients.

I’ll work with you to file all your seller disclosures on time, so you don’t have to worry about any tedious paperwork. My team’s goal is to minimize your exposure and keep everyone out of the courtroom. To learn more about how my team of commercial real estate agents can help you secure the best prices for your property, contact us at 818-482-3830.

MIG Commercial Real Estate Services Inc. and Alex Matevosian do not provide legal, tax or investment advice. Any published articles, blog posts, resources or other related material located on this website are for information purposes only. Please seek the advice of an attorney, tax professional, and/or financial advisor for legal, tax or financial advice.